Risk Management

Risk management is the process of:

- Identifying risks : Personal, Key Man, Property, Liability

- Assessing the probability and impact of potential loss

- Protecting against the consequences of loss

- Analyze and compare different alternatives for protecting the loss

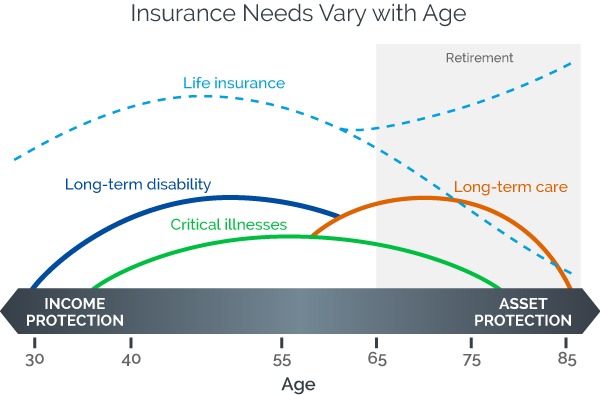

Proper planning and risk management can prevent the devastating effects of death, and expenses associated with disability, and long-term care. As you develop your financial strategies, be sure to protect your plans, assets and family against life's uncertainties. Insurance coverage can provide a solid foundation for your future, protecting you and those that depend on you for financial security. Some basic protection planning can help to ensure that you have the income and assets to meet your financial goals in the future.

Risks come in many forms and can wreak havoc to our financial lives. Stock market risks can destroy our best planned retirement. Personal risks from accidents can strip away our asset base. We begin our process by addressing all of our clients' potential risks and, where possible, suggest risk protection strategies.

Talk to a financial professional today.